If trading was so easy, why are so many traders losing money in the markets?

The truth is many people are paralyzed by their own beliefs about trading. Here are 8 of the most common myths people have.

Myth #1: I Have To Be Smart

Many people believe that they need to be smart, have certificates or diplomas, or attend special schools to become successful traders. This belief is understandable, given the complexity and intensity of the financial world.

However, this is not entirely true.

Being smart is not the most important factor in trading. Consistently making profits from the markets is what matters. Having a proven system, strategy, or formula is more important than being smart.

I was not smart and almost failed my ‘O’ levels. I only got into polytechnic because someone dropped out, and I had to retake some modules to complete my course. Even then, I went straight to work and skipped university (or college) all together.

Yet, I was still able to go on to make millions from the markets and teach others to do the same.

Many people let their doubts and fears stand between them and the fortunes they deserve. This self-doubt is just a little voice in their heads telling them that they are not good enough. It is essential to recognize this self-doubt and overcome it to become a successful trader.

The smart myth is just one of the many myths that prevent people from becoming successful traders. It is essential to recognize and overcome these myths and self-doubt to achieve success in trading.

Anyone can become a successful trader with a proven system, strategy, or formula and the determination to succeed.

Myth #2: I Need To Have Huge Capital

Another myth about trading that I believed when I started was that I needed a huge capital and had to be rich to succeed. However, I later found out that this was not true. Before I realized this, I was always losing to the markets with a small capital of a few thousand dollars.

Whenever I busted a trading account, I would tell myself that if only I had more capital, I could have been profitable. I thought that starting with a huge capital would allow me to beat the markets.

In order to raise capital, I became a real estate agent and worked very hard. I made over $200,000 in 2009 and over $300,000 in 2008.

By the end of 2009, I felt that I had enough capital to succeed in trading.

However, despite putting in half of what I made from real estate sales into trading (around $240,000), I lost more than half of it to the markets. I couldn’t understand why I was still losing with such a huge capital until I realized that the key to trading success is having a system or strategy that allows you to consistently profit from the markets.

This applies not only to trading but also to other industries. During the two years when I made half a million dollars as a real estate agent, I had a system in place to consistently generate sales figures.

I used to believe that trading was not for someone like me who was poor. I thought that only rich people could succeed in trading. However, I was born poor, and my family was so poor that my brother and I had to share one tiny plate of chicken and rice because we couldn’t afford a second plate.

During my younger years, I had to work high-labor jobs like a factory operator and a bartender to pay off my poly tuition fees. Through these jobs, I learned the value of money and the importance of hard work.

The reason I am sharing my story is that most people are not as poor as I was when I started trading.

If I could be successful in trading despite starting from a humble background, anyone can. As Bill Gates once said, “If you were born poor, it’s not your fault, but if you die poor, it’s your mistake.”

When it comes to trading, no one cares about your background or physical appearance.

The important thing is you can trade successfully and be consistently profitable. So, never feel inferior or look down on yourself just because you come from a humble background.

Trading is anybody’s game and it’s not only for the rich. It is based on your ability to profit from the markets and that’s it.

Myth #3: Long Hours Needed To Trade Successfully

And a lot of people think that they need to spend long hours trading to be profitable.

You know what I mean – spend numerous hours getting in touch with the news, learning how to interpret financial numbers and economic fundamentals.

That’s what I thought trading was all about. Sure, there is a lot of that in trading, but not all of it. And it’s not the only way to trade.

If it were the only way to trade, I probably wouldn’t be trading anymore.

During my real estate years, even though the money was good, I hated the job because of the long hours it required. I had to work late nights, weekends, and even public holidays because that was the only time when clients were free to meet. I practically worked almost 365 days a year.

Because of that, I barely had time to spend with my loved ones. And the thing I hated the most was that I barely had time to spend on my trading.

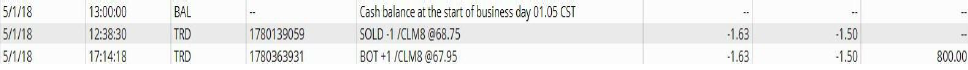

However, when it comes to trading, you do not need long hours to trade. Here is a screen shot of the trade results that I did on the 1st of May (Singapore Holiday – Labour Day).

I woke up around 11:00 a.m., did my morning rituals, went for my late breakfast, and then proceeded to power up my laptop to look at the markets for the next 10 to 20 minutes.

While I was looking at the markets, I saw this trade on crude oil. I put in my trade with my stop loss order, and after that, my family and I went out for the day because it was a Labour Day holiday in Singapore.

We had a late lunch while we were out, and it was around 5:00 p.m. when we came back.

When I accessed my trading account on my laptop, I saw the profit on the trade I did earlier and got out with a profit of US$800.

As you can see from the screenshot, I traded at 12:38 p.m. and got out at 5:14 p.m. The key thing here is that I didn’t use much of my time to do this trade or any of my other trades.

For this trade, it only took me roughly ten minutes to spot the trade and another ten minutes to put in the trade.

A total of just twenty minutes. After that, I went to do my personal stuff, came back, and used another five minutes to close the trade and take my profit, and that’s it.

As for monitoring my trades, I can if I want to, but I don’t have to monitor them if I don’t want to because I have my stop loss in place. I do not need to be staring at my trading screen while I am in a trade because staring at the screen does not help the price to move at all.

After I am in a trade, I can go do the things I want to do, like playing with my kids, watching a Netflix movie, or even hanging out with my friends.

Trading does take time, but not the kind of long hours compared to a 9 to 5 job or any typical jobs out there.

If you include the travel time to the workplace and the unexpected delays and hiccups, the people you need to deal with, you easily spend more than 8 hours for the 9 to 5 job!

Myth #4: Always Do More Analysis

A typical beginner trader will often use simple analysis to trade, but after a few losing trades and unsuccessful results, they may conclude that their analysis is incomplete. They might think that adding more analysis will lead to better results, but this often leads to spending more time without improving the results.

Many traders think that more analysis will make their analysis better and more complete, but this is not necessarily true.

Successful traders often simplify their analysis and focus on using the right ones and using them the right way.

The journey to becoming a successful trader often begins with simple analysis and then becomes more complex, but a small minority realizes that simplifying their analysis can lead to improved results. And it is that small minority group that proceeds to become successful traders.

After removing unnecessary analysis, traders can make money and profits from the market.

It is not about using more analysis, but about using the right ones and using them effectively. In this book, I’ll show you how to simplify your analysis and use the right ones to achieve better and faster results.

Myth #5: Trading Is Risky

The myth that affects our trading psychology a lot and deters most people from even getting into trading is that they think that trading is risky.

But the truth is that risk comes from not knowing what you’re doing.

I had the privilege of going skydiving and when I was in the sky preparing for the skydive, I was really afraid. But I told myself that this is something that I wanted to do in my lifetime, so I went for it.

During the flight, I asked my skydiving instructor, “Is skydiving risky?” He told me the same thing – risk comes from not knowing what you are doing. He said that he knows exactly what he is doing, so skydiving for him is really safe.

He went on to tell me that he would rather skydive than drive a car because he feels that skydiving is safer than driving a car. When I asked him why, he told me that he knows more about skydiving than he knows about driving a car, even though he knows how to drive.

That conversation reinforced my conviction that trading is very safe for me. I have never viewed trading as risky because I have acquired the skill set and system in place to protect myself against risky trading.

In terms of trading, anyone can have the ability to trade the markets safely, but you need to know how to do it.

Myth #6: Trading Is All About Luck

There is also a common myth that trading is just like gambling and purely based on luck. However, let’s examine the business model of a casino to understand this better since a lot of people consider that to be in the business of luck.

It’s reasonable to say that in a single bet, the casino has a chance to win or lose. But when considering the outcome after one year, is it really a game of chance and luck for the casino?

Despite the occasional wins and losses, will they be profitable or not?

It’s highly likely that the majority of people would agree that the casino will make a profit after one year, year after year, despite being in the business of gambling and chances. It’s a massively profitable industry for casino owners and operators, and once they’re in business, they’re rarely out of business.

However, the owners and operators of the casino don’t view it as a luck-based business for themselves. They view it as a business of consistent income, where every game they offer has a higher probability of winning than losing.

Even though in a single bet, they may win or lose, in the long run, after thousands or millions of bets (after stacking the odds thousands or millions of times in their favor), they will come out on top and be profitable, generating a consistent income from millions of bets on each game.

Similarly, trading can also generate consistent profits with the right strategy, risk management, and knowledge. It’s not merely a game of chance or luck, but a business where those who know what they’re doing can consistently profit over time.

This can be the same for trading, because trading is not about luck, but about probability and having an edge on your side, just like the casino. They have an unfair advantage, even though they can still lose in every single bet. It’s an advantage that stacks the odds in their favor a thousand or million times over, which is why in the long run they make massive, consistent profits.

Trading is a business, just like the casino, that makes massive, consistent profits when the trader has an edge, an unfair advantage, every time they make a trade. Now, let’s examine the casino model so that we can structure our trading just like the casino to have an unfair advantage.

The first thing a casino has is a game plan that outlines all the possible scenarios their game offers. From there, they set game rules to ensure they have an unfair advantage. Finally, they can calculate the odds payout so that with the odds payout, they will have an unfair advantage as well.

With all these key components in place, the game plan, the rules, and the odds payout, the casino has more than a 50% probability of winning in every single bet. It’s an unfair advantage that’s stacked after thousands of bets, ensuring that they will definitely be on top and making a profit.

In terms of trading, we must model how casino owners operate their casino. In terms of a game plan, we need to have a trading plan that maps out all the possible scenarios that could occur so that we can make plans to react to them in a way that gives us an unfair advantage and stacks the odds in our favor.

With the game plan in place, we set up trading rules like entry and exit rules, money management rules, etc., that are designed to give us an unfair advantage. Finally, we determine the risk-to-reward ratio, which is how much we stand to gain when we win and how much we stand to lose when we lose.

By designing our trading plan, rules, and risk-to-reward ratio in a way that stacks the odds in our favor, I was consistently beating the market. Just like the casino operator, even though there’s a chance I might lose in every single trade, after many trades, it’s almost 99% certain that I will make a profit.

Myth #7: If I Find The Magic Bullet, I’ll Be Successful

Many people enter into trading with the false belief that there is a magic bullet that will make them rich quickly. However, trading success does not require such a thing.

I believe that the real key to success in both life and trading is having a system or strategy that allows you to create your own source of income. When you have this, you gain true freedom and control over your life.

Unfortunately, many people do not understand the importance of having a system, strategy, or formula. Without one, they are unable to produce consistent results and often experience poor results instead.

In fact, 96% of all failures are due to not having a system in place.

Having a system gives you a better chance of achieving good results. Those who are successful, have a system that they follow consistently to produce the desired outcome.

A system or strategy is key to success in anything, including trading. In my experience with real estate sales, I found success not because I was particularly skilled, but because I followed the system my sales manager taught me. This applies to trading as well.

If there is such a thing as a “magic bullet,” it is the system, strategy, or formula that, when applied, produces consistent results time and time again.

Myth #8: News And Fundamentals Move The Markets

The last myth about trading that I want to share with you is that many people believe they need to follow news and fundamentals to profit from the markets. I used to be one of them, but not anymore.

To understand what makes any market move, we need to realize that emotions such as fear cause markets to fall, while greed causes them to rise.

Additionally, we need to acknowledge that price already reflects all market information, including fear and greed, as well as fundamentals like earnings per share, potential earnings ratio, or even the news; they are all factored into the price.

If that is the case, then the way price moves is all anyone would need to make a trade. This can only be achieved by using technical analysis, which reflects current and historical price movements. I’m not saying you shouldn’t use fundamentals, but they should only be used for an overall macro view, not for timing, as they are almost never on time.

When it comes to timing, momentum is key, and price is the best way to see momentum.

That’s why we use technical analysis. I want you to know that we are just scratching the surface here.